Challenging times ahead for businesses in the new financial year (FY24)

June 22nd, 2023 Posted by Gobbill Business Management, Financial Management, Time Management 0 thoughts on “Challenging times ahead for businesses in the new financial year (FY24)”Business Outlook for FY24 – Challenging times ahead for businesses

Many Australian businesses especially SMEs businesses are struggling with cashflow due to higher inflation and interest rates. The Reserve Bank of Australia (RBA) has raised the official interest rate known as cash rate to 4.1% in June 2023 to tackle the high inflation level of 7% (March 2023). “In short term, this actually put on more pressure on consumers and SMEs alike.” says Mr Rajic, Founder of Small Business Loans Australia.

CreditorWatch Chief Executive, Patrick Coglan says “The new financial year 2024 is looking tough for businesses with insolvencies at a 10-year high and trading conditions further weakening”. Further from Trading Economics statistics, the bankruptcies in Australia have increase to 387 companies in May 2023 as compared to 308 companies in April 2023. Signs from commercial property index remains weak at -6 for Q1 2023 as reported by NAB – Commercial Property Survey (Q1 2023) specially affecting the retail (-32) and office (-16) properties still in negative zone.

Household consumption growth is expected to remain sluggish through this year as inflation and higher interest rates weigh on real disposable income. “It is unlikely be a cut to the cash rate until both goods and service inflation is on a sustained downward trend and the unemployment rate is roughly at 4.5%” (vs April 2023 at 3.7%), accordingly Ms Anneke Thompson – Chief Economist of CreditorWatch.

Alarm bells should be ringing for business owners to focus on cashflow management as it is crucial for businesses to survive in these economic conditions. The most practical approach for businesses to be in a healthy financial position is to:

1) Optimise its cashflow with steady inflow – collections via:

- Timely billing of invoices to clients – minimise delay in collection

- Early payment incentives to clients – encourage prompt settlements

- Expanding payment options – allow flexibility to encourage prompt settlements

2) Filing of tax returns – ensure any funds owed are returned to the businesses promptly

3) Payment to suppliers on time or to negotiate for favourable payment terms (i.e. longer payment terms or early payment discounts)

The efforts above will be better managed by an automated platform to automate collections from clients when it’s due, streamline the follow-ups process and paying invoices on time to suppliers.

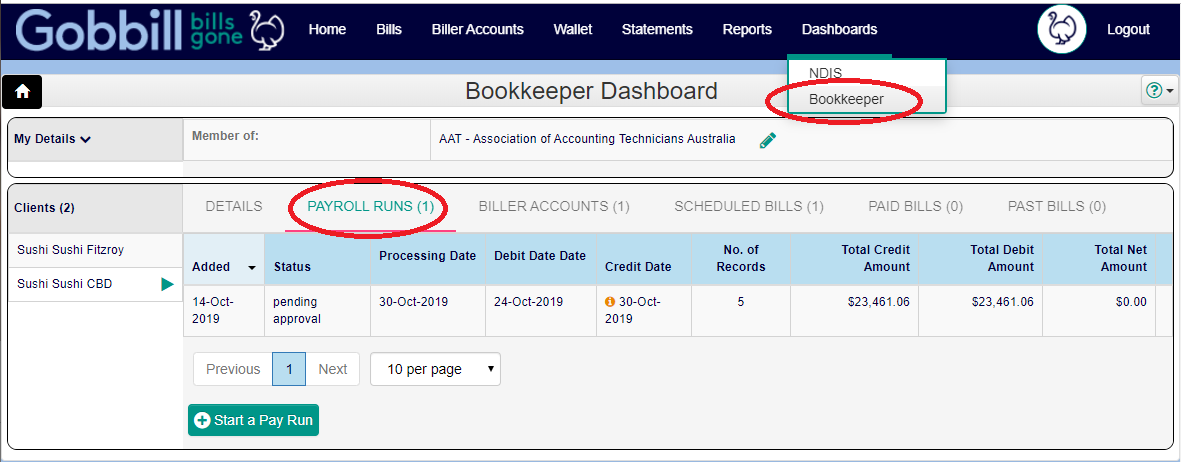

Gobbill is a solution used by many businesses to organise and automate their collections from clients and payments to suppliers.

Accounts Receivable automation: Business owners can easily forward their invoices into Gobbill for the system to debit their clients’ bank account before the due date. A client direct debit authority will need to be in place. It eliminates money handling, money transfers or even having to chase for payments.

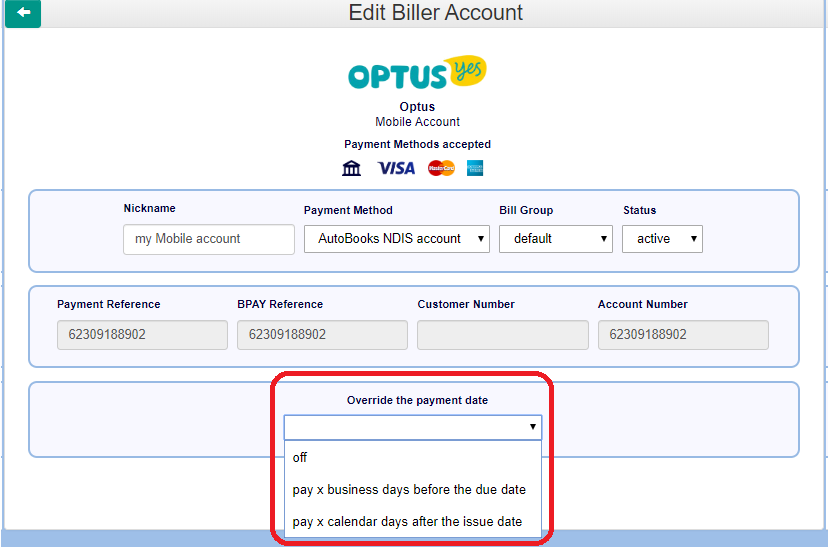

Accounts Payable automation: For payments of invoices, the system automatically does the data entry of invoice (no need to type anything it), checks for any fraud/scams, pays just before the due date and allocates it to correct expense account. This reduces significant administration and reconciliation time. The invoices are then stored in one place which removes the hassle of finding all the expenses/ invoices when it comes to tax time. Our clients can synchronise the data into Xero or just export a file for their accountant which also contains all the information required including the associated clients/entity for the bill.

Contact us to find out more about Gobbill – automated collections and bills payment platform or email [email protected]

Sources:

1) Accountants Daily – Businesses told to brace for ‘challenging’ FY2024

https://www.accountantsdaily.com.au/business/18651-businesses-told-to-brace-for-challenging-fy-2024

2) Augusta – Margaret River Mail – Australian businesses are struggling with cash flow due to inflation and high interest rates

3) Commercial Real Estate – The commercial property outlook for 2023

https://www.commercialrealestate.com.au/news/the-commercial-property-outlook-for-2023-1188460/

4) Trading Economics – Australia Bankruptcies

https://tradingeconomics.com/australia/bankruptcies

5) Reserve Bank of Australia – Economic Outlook (May 2023)

https://www.rba.gov.au/publications/smp/2023/may/economic-outlook.html