Photo of Dr. Paul O’Keefe, Practice Owner of Premier Health Partners

Paul is a small business owner who has overseen the growth of his clinic from humble beginnings to what is now a fully multi-disciplinary medical clinic, combining osteopathy with general practice, physiotherapy, myotherapy, clinical psychology, dietetics and remedial/sports massage.

As his practice grew, Paul was spending more time and energy on managing his accounts payable. Instead of closing up for the day and spending time with his family, he would be sorting out admin. Paul heard about Gobbill from one of his patients. Since signing up and using it for a while, here’s what he has to say:

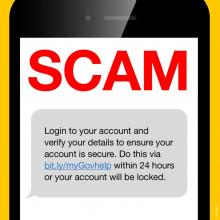

“Gobbill takes the stress out of bill payments for my business. Once the account is setup everything is totally automated. I just email bills to my Gobbill account and I know they’ll be digitised and paid on time and that Gobbill will check for any duplicate or fraudulent bills. Every few weeks I log in and sync bills to Xero, and that’s my whole accounts payable process done as simple as that.

Gobbill

has saved me heaps of time and makes bill payment so easy. It’s a part of my

business I don’t even think about anymore, you just set and forget it and know

everything is being done right. I would recommend Gobbill to other business

owners out there looking for a solution to their accounts payable process.”

By automating the accounts payable aspect of his business using Gobbill, Paul has been able to save time and effort on admin which he has estimated to be around $30,000 per annum. It helps him to manage his cashflow with maximum control and minimal effort.

Many business owners using Gobbill have saved up to 70% of their time spent and around $30,000 per annum on managing their accounts. These include medical health clinics, osteo/physio clinics, dental clinics and more.

Find out more about how Gobbill can help your business, contact Tonisha at [email protected] or visit gobbill.com